📊 Finance Through the Lens of a Restaurant

🍷 If you can manage a restaurant’s numbers, you can run nearly any business.

Meet Paul, an aspiring restaurateur with a dream to serve exquisite Thai-French fusion cuisine.

1. CAPEX vs OPEX: The Foundation and the Fuel

To get started, Paul has two options :

Option A: Build from scratch

Paul could construct a beautiful two-story building with a terrace. The cost? $2 million upfront.

This is Capital Expenditure (CAPEX) — one-time investments in physical assets that will serve the business long-term. It’s like buying the car instead of renting a cab daily.

Option B: Rent a cozy city-center space

Instead, Paul finds a charming spot downtown for $72,000 per year.

This is Operating Expenditure (OPEX) — recurring costs for running the business day to day.

He chooses Option B to preserve cash and reduce risk.

2. The Setup: Fixed and Variable Costs

After months of planning, design, and menu testing, Paul finally opens the restaurant.

🧑🍳 Team Setup (Fixed Costs - OPEX)

He hires a solid crew:

1 Head Chef

1 Sous Chef

2 Waiters

1 Front Desk Host

Total annual salary expense: $420,000

This is a fixed operating expense — it doesn’t change based on how many guests show up.

🥕 Ingredients & Supplies (Variable Costs - OPEX)

To serve his delicious meals, he needs fresh produce, spices, and wine.

These raw materials cost $360,000 per year, and they scale with the number of meals served.

These are variable costs — if no one eats, he doesn’t need ingredients.

💡 Utilities and Other Ongoing Expenses

Things like electricity, water, marketing, insurance, POS software, repairs, linens, etc.

These fall under OPEX, often fixed or semi-variable. Annual cost: $190,000

3. Revenue and Profitability

Paul’s restaurant becomes a hit!

👥 Customer Flow

He serves 66 guests per day, across lunch and dinner.

💸 Revenue

The average customer spends $50 per meal:

66 guests/day × 365 days × $50 = $1,200,000 in annual revenue

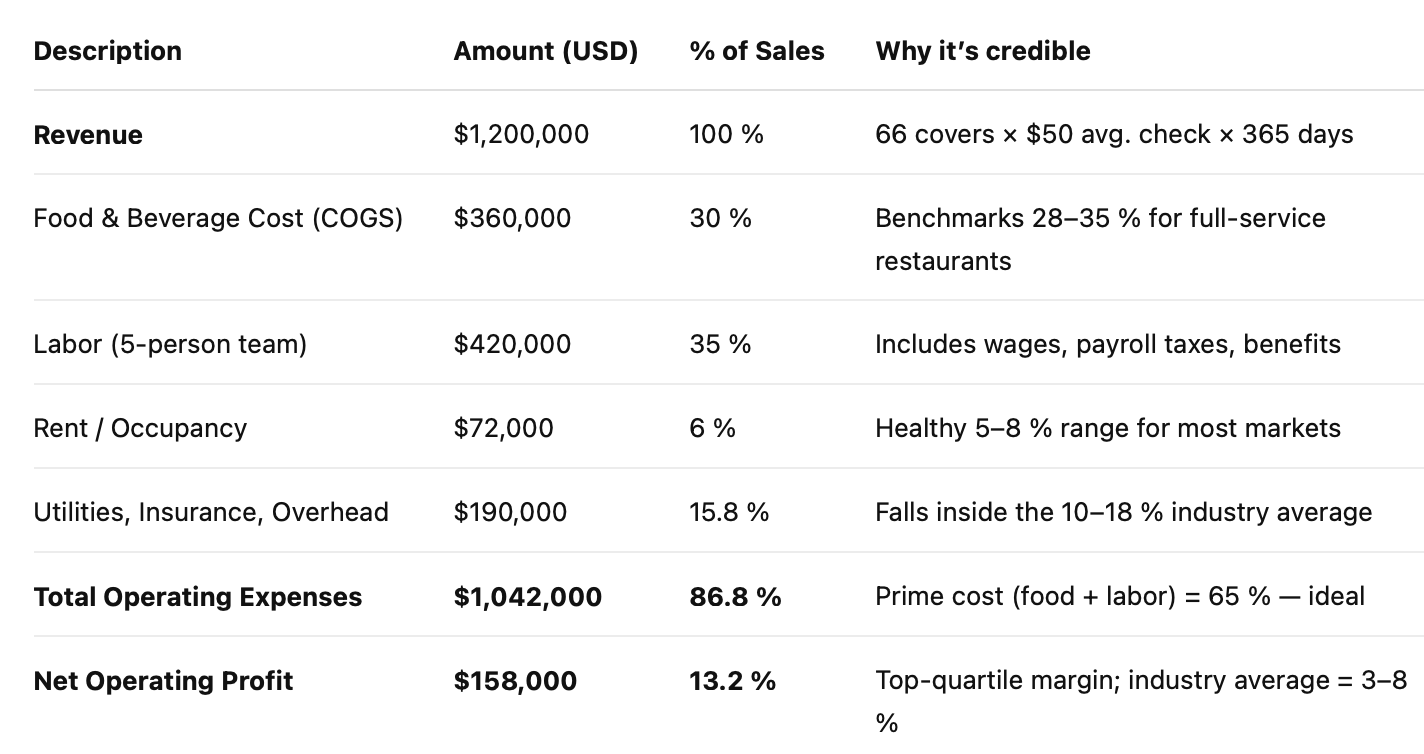

4. The P&L Snapshot

5. What Paul Can Do With Profit

Paul now has $158,000 in net profit. This is the bottom line — the sweet fruit of all his planning.

He has choices:

🏡 Take it home as a dividend or salary (owner’s earnings)

🔧 Reinvest in upgrading the terrace, adding heaters, or launching delivery

📈 Save to eventually build his dream 2-story terrace restaurant (future CAPEX)

6. Bonus: Cash Flow and Break-Even

💰 Break-even point: When revenue = total operating expenses. For Paul, that’s roughly 52 guests per day.

💸 Cash flow ≠ profit: Even if the restaurant earns profit on paper, cash must be well managed to handle supplier payments, tax deadlines, and equipment emergencies.

🍽️ Conclusion

Running a restaurant is a perfect microcosm of managing a business financially:

CAPEX builds your infrastructure.

OPEX fuels day-to-day operations.

Fixed vs Variable Costs define your scalability and risk.

Profitability is about margin discipline, not just revenue.

Cash Flow is your true oxygen — run out, and it’s game over.

🍷 If you can manage a restaurant’s numbers, you can run nearly any business.